Sales Tax Calculator

The Sales Tax Calculator tool allows you to quickly and accurately calculate the sales tax for your purchases, providing both the total amount and the tax amount. This tool is perfect for shoppers, business owners, and tax professionals who need to determine the sales tax on goods and services for budgeting or accounting purposes. The process is simple, ensuring you get precise results every time.

Result

| Net Amount | ||

|---|---|---|

| Tax Rate | ||

| Gross Amount |

Share on Social Media:

Easy Sales Tax Calculator - Accurate & Fast Tax Solutions for Every Purchase

Calculating your sales tax shouldn’t be a hassle. With our quick and reliable sales tax calculator, find out exactly what you’ll owe in seconds. Ready to dive into the nitty-gritty of sales tax rates across the board? Let’s get started.

Key Takeaways

Sales tax is a consumption tax paid to the government on the sale of certain goods and services, varying in rates across states, essential for compliance with state and federal laws, and makes up a significant portion of state income.

Sales tax rates differ from state to state and may include additional local sales taxes; businesses must navigate these complexities to ensure accurate calculations and remain compliant with varying tax obligations.

Effective sales tax management for businesses involves understanding the concept of sales tax nexus, leveraging technology to automate compliance, and recognizing the impact of sales tax on tax returns, including opportunities for deductions.

Understanding Sales Tax and Its Importance

A sales tax is a type of consumption tax that is paid to the government when certain goods and services are sold. This tax is typically added to the purchase price at the point of sale. It’s imposed at the point of sale by retailers and accounts for about 2% of an American’s personal income, indicating its significance in daily transactions. If you’ve ever wondered why an item costs more at the cash register than the price tag, that’s sales tax at work.

But it’s not just consumers who need to understand sales tax. Businesses, whether they operate a brick-and-mortar store or an online platform, must know how to calculate, collect, and pay sales tax. This ensures they’re compliant with state and federal laws and that they’re not under or overcharging their customers.

The Basics of Sales Tax

At its core, sales tax is a tax applied to the sale of goods and services. However, not all items are subject to sales tax. Groceries and certain business purchases, for instance, are commonly exempt. These exemptions can vary between states. Regular grocery items in Massachusetts are not subject to sales tax, which makes it more affordable for consumers to purchase essential goods..

One of the key features of sales tax is its transparency. When you purchase an item, the amount of sales tax you pay is clearly stated on the receipt. This allows consumers to see exactly how much they’re contributing to state revenues with each purchase.

The Role of Sales Taxes in State Revenue

Sales taxes do more than just add to your shopping bill; they also make up nearly one-third of state governments’ total income. In 2021, sales taxes generated a whopping $477 billion, making up 12% of the general revenue for state and local governments.

Certain states, like:

Florida

Washington

Tennessee

Texas

are particularly reliant on sales tax for their tax revenue. This dependence further underscores the importance of accurate sales tax calculations, both for businesses collecting the tax and for consumers understanding where their money is going.

Navigating Sales Tax Rates Across States

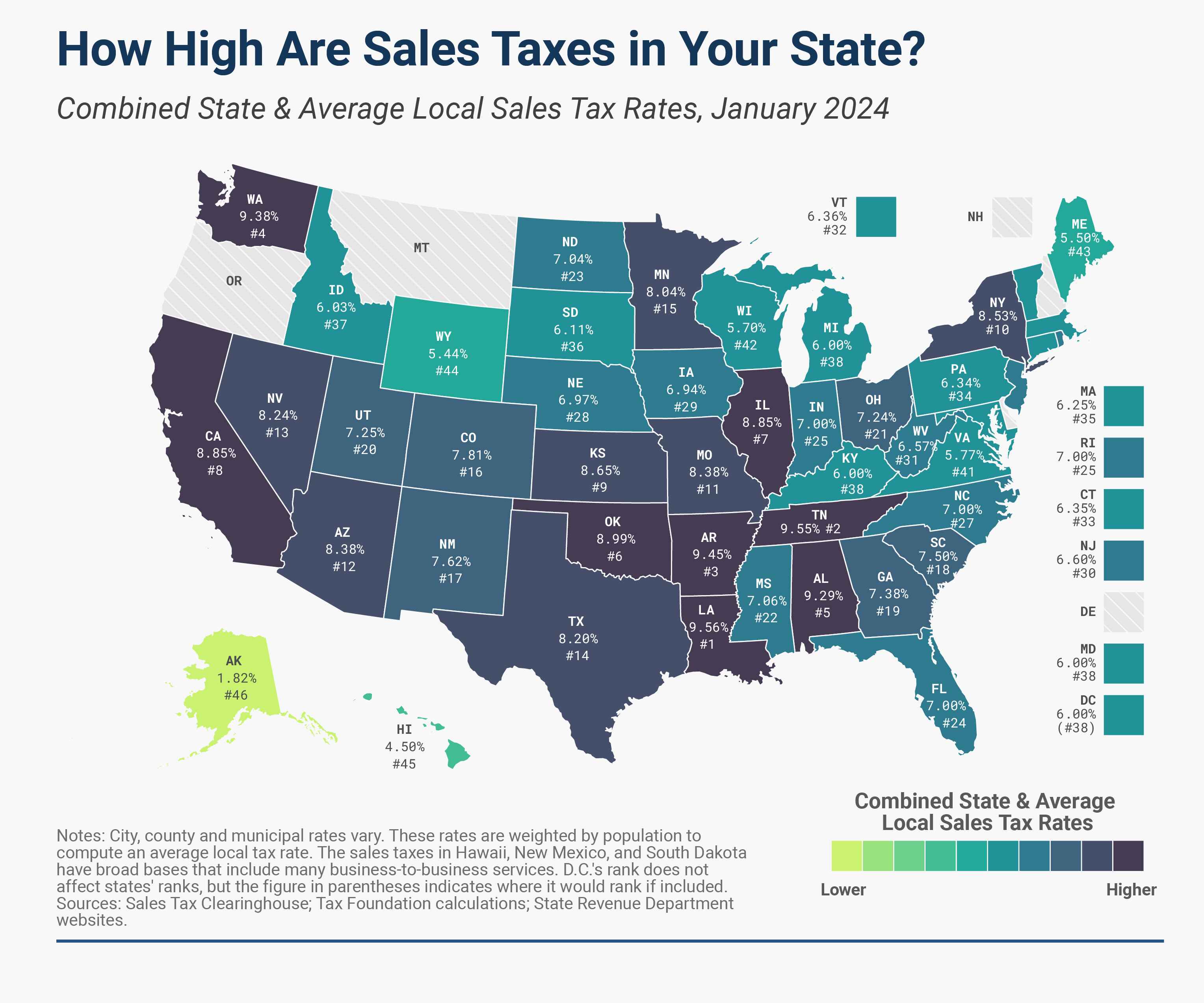

As we’ve seen, sales tax plays a significant role in state budgets. But the rate at which sales tax is charged can vary widely from state to state, and even within the same state. This variability can make calculating sales tax a complicated task for businesses operating in multiple states or for consumers making purchases across state lines.

For example, four states - New Hampshire, Delaware, Montana, and Oregon - have no sales taxes at all, while Alaska has no statewide sales tax but allows local jurisdictions to impose their own. On the other hand, general sales tax rates in states like Colorado and California can vary significantly, with the former having the lowest state rate at 2.9% and the latter the highest at 7.25%.

To add to the complexity, local governments in 38 states can levy their own sales taxes on top of the state’s general sales tax, potentially increasing the total tax rate that consumers pay.

State-by-State Guide to Sales Tax

A reliable resource for checking current rates is invaluable given the variability in state sales tax rates. However, when you look at the state-by-state guide, you’ll find a wide range of rates. For example, Colorado has the lowest state sales tax rate at 2.9%, while California has the highest at 7.25%.

Moreover, when you factor in local sales tax rates, the general sales tax rates can significantly increase. For instance, local tax rates can range from 0.5% in Hawaii to 8.3% in Colorado. To find the most current state sales tax rates, you can utilize resources such as the State and Local Sales Tax Rates, 2023 tables or Wikipedia Tax Tables by State.

Local Sales Tax Nuances

Local jurisdictions have the authority to impose their own sales taxes in addition to the statewide sales tax, resulting in varying local sales tax rate for the same item in different locations. In 38 states, consumers must pay local sales taxes along with state taxes, which can lead to higher combined sales tax rates.

The number of taxing jurisdictions with general sales taxes can vary significantly from a few in some states to thousands in others, contributing to the complexity of tax rates within these states. This variation underlines the importance of precise tax calculations, as even adjacent addresses can have different tax rates due to differing local sales tax rates.

Sales Tax Compliance: Calculating What You Owe

Given the complexity of sales tax rates across different states and local jurisdictions, businesses must ensure accurate tax calculations to comply with tax regulations. Businesses must understand their sales tax nexus, which is the connection between a business and a state that establishes tax requirements.

Failing to collect or pay the correct amount of sales tax can lead to penalties, interest charges, asset seizure, and credit damage for a business. To avoid these consequences, businesses must charge sales tax and convert the tax percentage to a decimal by dividing it by 100 to calculate the sales tax amount owed accurately.

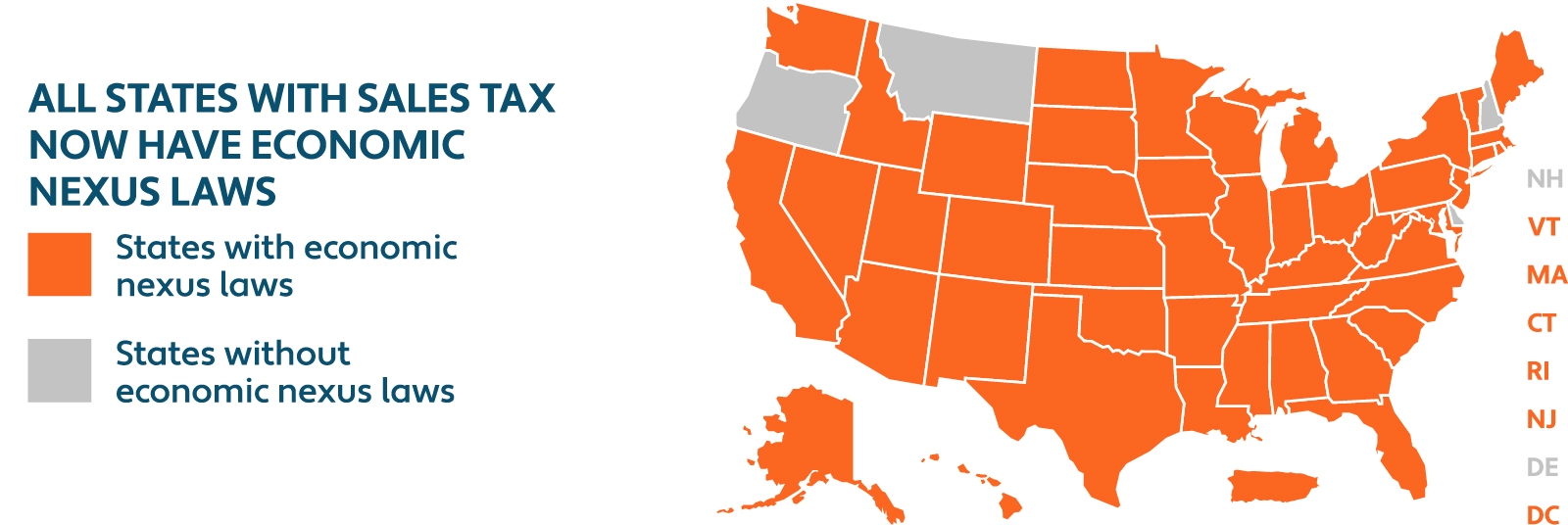

Determining Your Sales Tax Nexus

‘Sales tax nexus’ is a fundamental concept in sales tax compliance. This is the connection between a business and a state that creates a sales tax collection requirement. A nexus is typically established through a physical presence, such as an office, employee, or warehouse in a particular jurisdiction.

However, the concept of a nexus has evolved with the growth of online businesses. Economic nexus laws may require businesses to collect sales tax if they exceed a certain threshold of sales or transactions within a state, even without a physical presence. Moreover, affiliate nexus can occur when a business affiliates with another company that has a physical presence in the state, while click-through nexus involves partnerships with in-state third parties that refer customers to the business.

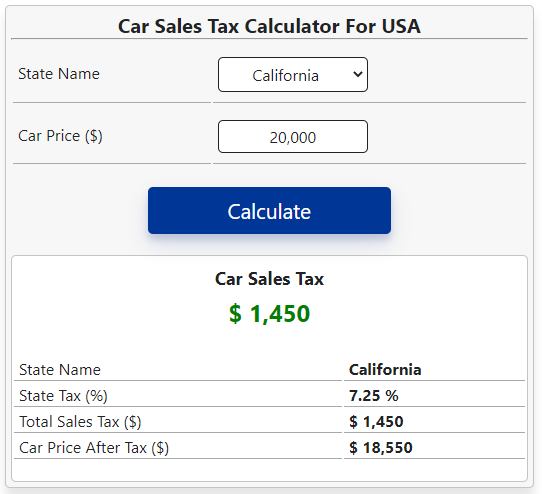

Automating Sales Tax Compliance

Automation can simplify the process for businesses, despite the complexities of sales tax calculations. Online tools can streamline the process of calculating and filing sales taxes, ensuring accuracy and saving time. These tools often come with advanced features like product exemptions, sourcing logic, and shipping taxability, which can enhance the automation of sales tax calculations.

One such tool is the Sales Tax Calculator by PagesTools.com, which is designed to assist businesses and individuals with accurate and fast sales tax calculations. With this tool, businesses can focus on their core operations, knowing that their sales tax compliance is taken care of.

Step-by-Step Guide to Using a Sales Tax Calculator

Understanding the importance and complexity of sales tax calculations, it’s time to examine how to use a sales tax calculator. These calculators provide quick estimates of sales tax and the total purchase price, based on the item price and state sales tax rates.

To calculate sales tax, follow these steps:

Multiply the price of the item or service by the tax rate.

To find the tax amount using an online calculator, convert the tax rate percentage into a decimal value by dividing it by 100.

Apply the tax rate to the item price.

Inputting Purchase Details

Using a sales tax calculator begins with:

Inputting the list price of the item or service to be purchased.

Entering the applicable tax rate into the calculator to determine the sales tax.

Calculating the total purchase cost by adding the sales tax to the list price.

It’s important to note that these calculators require accurate location details, such as city and ZIP code, to ensure precise tax calculations.

Interpreting the Results

After entering the purchase details, the sales tax calculator will determine the overall sales tax rate for the purchase, combining the applicable state and local tax rates. Understanding each component’s rate is key to interpreting the results, as local tax rates are added to the state sales tax to provide the total tax rate applicable.

However, it’s not just about understanding the total tax rate. Variance in local sales taxes, such as special tax districts or exemptions, must also be considered as they can affect the final calculated tax displayed by the sales tax calculator. With a clear understanding of the results, you can ensure your sales tax calculations are accurate and compliant with state and local regulations.

Maximizing Deductions: Sales Tax and Tax Returns

Apart from daily transactions and business operations, sales tax also influences your tax returns. Taxpayers have to choose to claim either state and local income taxes or sales taxes as a deduction on their tax returns, but cannot claim both. Each year, only less than 2% of Americans report sales tax as a deduction on their tax returns. This indicates that the majority of taxpayers do not take advantage of this deduction..

So, when does it make sense to deduct sales taxes? The answer lies in understanding when to itemize deductions and how large purchases can impact your sales tax deduction.

When to Itemize Deductions

For taxpayers, itemizing deductions can be a strategic decision. Individuals should consider doing so if the combined total of eligible expenses, including sales taxes, exceeds the standard deduction for their filing status.

In particular, taxpayers may benefit from itemizing deductions for sales tax if the amount they paid in state and local sales tax is greater than what they paid in state and local income tax. Furthermore, those who made significant purchases during the year may find it advantageous to itemize, as these can contribute to surpassing the standard deduction threshold.

Large Purchases and Sales Tax Deduction

For large purchases like vehicles, taxpayers have the option to claim deductions either by saving all their receipts and deducting actual sales taxes paid, or by using IRS tax tables and adding the sales tax paid on those big-ticket items. However, the sales tax deductions for such large purchases can only include the amount corresponding to the general sales tax rate unless the rate paid was equivalent to this general rate.

For taxpayers who have made significant purchases, it may be more advantageous to deduct sales taxes rather than state income taxes when the total sales tax exceeds the state income tax payments. But remember, if you’re claiming a vehicle used for business purposes on a business return, you cannot additionally deduct the sales tax on Schedule A of your individual Form 1040.

Summary

Understanding and accurately calculating sales tax is a crucial skill for both consumers and businesses. From its role in state revenues to its implications for tax returns, sales tax impacts our daily lives and financial decisions. We’ve delved into the complexities of state and local sales tax rates, the concept of sales tax nexus, and the benefits of automating sales tax compliance. With tools like the Sales Tax Calculator by PagesTools.com, calculating sales tax can be a seamless, error-free process. Remember, accurate sales tax calculations are not just about compliance; they’re about making informed decisions that can save you money.

Frequently Asked Questions

What is the sales tax on a $14000 car in Missouri?

The sales tax on a $14000 car in Missouri is 4.225%. This means you would pay $591.50 in sales tax.

What is sales tax nexus?

Sales tax nexus is the connection between a business and a state that creates a sales tax collection requirement, established through physical presence, economic activities, or affiliations.

How can I calculate the sales tax on a purchase?

To calculate the sales tax on a purchase, multiply the price of the item or service by the tax rate. You can use online tools like the Sales Tax Calculator by PagesTools.com for simplification.

How do I know if I should itemize sales tax deductions?

Consider itemizing your deductions if the total of eligible expenses, such as sales taxes, is higher than the standard deduction for your filing status. This can be particularly beneficial if you've paid more in state and local sales tax than in state and local income tax.

Can I claim a sales tax deduction for large purchases?

Yes, you can claim a sales tax deduction for large purchases such as vehicles, but the deduction is limited to the general sales tax rate unless the rate paid was equivalent to this general rate.